Personal Tax Account and HMRC Online Services

Managing your taxes in the UK can seem like a challenging task, but with the help of digital services like HMRC Personal Account (Her Majesty’s Revenue and Customs), it has made it easier than ever. For instance, you can easily track and manage your taxes online without the need for in-person meetings. Furthermore, in this blog, we will guide you through everything you need to know about Personal Tax Accounting. To begin with, setting up your very first HMRC Income Tax Account, learning how to create a Personal Tax Account HMRC, and understanding how to benefit from HMRC Online Services. Moreover, if you are interested in deepening your understanding of tax systems and accounting, enrolling in a Tax Accounting course could be a great way to enhance your knowledge.

Table of Contents

What is a Personal Tax Account?

Your Personal Tax Account is an online portal provided by HMRC. IT gives you access to your tax-related information, manage payments, file returns, and stay updated on your financial obligations. Infact, it gives you an overall preview of your tax situation. It includes showing the:

- Income You Have Reported,

- Tax You Paid,

- Status of Your HMRC Income Tax,

- Other Financial Details

This HMRC Personal Account provides you with an easy-to-use, secure way to manage your tax affairs, including filing returns, tracking payments, and making updates to your personal tax details. In addition, you can access the account via the official HMRC website. Moreover, it can be used for a variety of services, ranging from paying your taxes online to updating your address.

Furthermore, if you are curious about learning more about how tax systems work, a Tax Accounting course can be a superb method to start your accounting career. These courses, in particular, teach you the fundamentals of tax management. It also provide you with real-world insight into financial accounting practices and tax laws.

How to Create a Personal Tax Account

Creating a Personal Tax Account is straightforward and can be done in a few simple steps. Here’s how to get started:

- Visit the HMRC Website: Go to the official HMRC website and look for the ‘Sign In’ or ‘Create Account’ section. Therefore, you’ll be asked to create an HMRC Personal Account, which is a must for using HMRC Online Services.

- Enter Your Details: To create your HMRC Income Tax Account, you’ll need to provide personal information, including your full name, National Insurance number, and a valid email address. Additionally, you may also need to provide additional information depending on your circumstances.

- Secure Your Account: HMRC will ask you to create a strong password and provide security details. Therefore, this step is crucial to ensure that your HMRC Services are protected. Try to set a hard password which can’t be easily guessed or cracked.

- Activate Your Account: Once you’ve completed the sign-up process, you’ll receive an activation code via post. In addition, this code is necessary to activate your Personal Tax Account HMRC.

- Login and Manage Your Account: After activation, you can log in to your HMRC Account at any time. Moreover, from here, you can manage your tax returns, make payments, and check your tax records on the go.

For anyone wanting to take their tax knowledge to the next level, a Tax Accounting course provides an excellent foundation. In addition, it will help you understand the complexities of tax regulations, accounting practices, and how to manage different types of taxes effectively.

Setting Up Your Personal Tax Account

Once you’ve created your Personal Tax Account HMRC, it’s an ideal time to set it up properly so that you can take full advantage of it. These are few essential tips to help you get started:

- Link Your National Insurance Number: Your Personal Tax Account HMRC will be linked to your National Insurance number, so double check it. Moreover, you’ll need it for all tax-related works, including income tax and National Insurance contributions.

- Check Your Tax Codes: In your HMRC Income Tax Account, you can verify your tax code. Consequently, you’ll ensure you don’t overpay or underpay tax. If you find any mismatches, you can update it directly through your Personal Tax Account.

- Set Up Alerts and Notifications: You can personalise your HMRC Services in the account settings. Additionally, you can set up notifications for key tax dates, such as deadlines for paying bills or submitting returns. As a result, this can help you avoid missing important deadlines to stay organised and avoid penalties.

- Add Your Bank Details: You can link your bank accounts to your HMRC Personal Tax Account for easy payments and refunds. Thus, this simplifies paying taxes online or receiving refunds directly into your account.

By setting up your HMRC Personal Account, you’ll be ready to navigate your taxes seamlessly. Furthermore, for those interested in a more structured approach, enrolling in a Tax Accounting course can provide professional skills to manage taxes efficiently in both personal and business contexts.

Tax Accounting

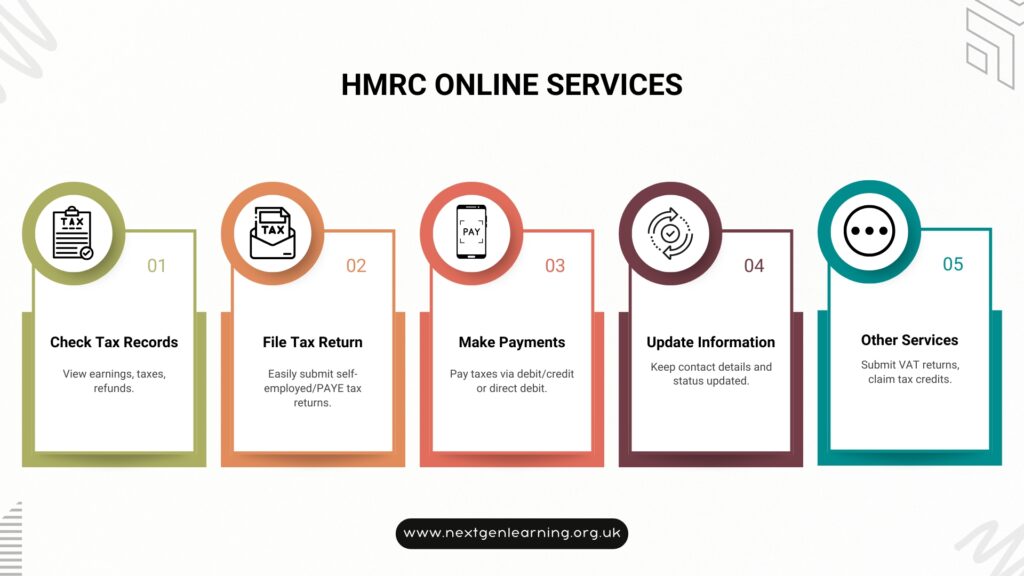

HMRC Online Services: What Can You Do with Your Personal Tax Account?

The best features of your HMRC Personal Account are HMRC Online Services. Here are a few services you can use once you’ve set up and logged in to your account.

- Check Your Tax Records: One of the main features of the HMRC Income Tax Account is that it shows you a breakdown of your earnings and taxes paid. In addition, you can view how much tax you owe, see if you’re eligible for a tax refund, and check your payment history.

- File Your Tax Return: Whether you’re self-employed or filing as a PAYE (Pay As You Earn) employee, your HMRC Account makes it easy to file your annual tax return. Moreover, the account provides a user-friendly platform to submit your tax information quickly.

- Make Payments: If you owe taxes, you can pay directly through your HMRC Services using a debit or credit card, or set up a direct debit. Additionally, your account will show you exactly how much is due and when payments are due.

- Update Personal Information: Your HMRC Personal Account allows you to keep your details up to date, whether that’s changing your address or updating your marital status. Therefore, it’s important to keep this information accurate to avoid issues with your taxes.

- Access Other Services: Apart from managing your taxes, HMRC Services also include things like submitting VAT returns, claiming tax credits, and checking your state pension contributions.

For those wanting to go beyond basic tax management, a Tax Accounting course can teach you advanced tax strategies and financial reporting. As a result, it will further enhance your ability to navigate the world of taxes and accounting.

Conclusion

In the UK, a personal tax account is a crucial instrument for tax management. Additionally, you can access a secure online portal to check your HMRC Income Tax Account, file returns, make payments and manage your tax affairs by creating an HMRC Personal Account. Moreover, you may streamline your tax administration and guarantee that you constantly adhere to UK tax regulations with the aid of HMRC Online Services.

Spend some time setting up your Personal Tax Account with HMRC right now if you haven’t already. Moreover, after everything is set up, you may easily manage your taxes and use HMRC Services anytime you need them.

You can keep informed about your tax status, save time, and reduce stress by utilising the resources that are accessible through your HMRC Personal Account. Furthermore, a Tax Accounting course provides thorough instruction on tax systems, accounting procedures, and effective tax management in both personal and business settings for anyone wishing to expand their expertise.

Related Courses

Categories

All Courses

Personal Development

645

Employability

404

Health & Care

320

Management

300

IT & Software

284

Business

266

Quality Licence Scheme Endorsed

257

Safety & First Aid

217

Teaching & Education

163

Accounting & Finance

146

Design & Technology

121

Construction & Engineering

117

Mental Health & Counselling

117

Sales & Marketing

111

Compliance & Law

97

Food & Nutrition

83

Science

71

Sports & Fitness

54

Language

50

Animal Care

41

Photography & Lifestyle

35

Cybersecurity

28

Makeup & Beauty

24

Programming & Coding

20

Business Communication

15

Job Ready Programme

14

Career Bundle

13

Development

10

Data & Analytics

10

Organizational Development

9

Leadership Development

8

Risk Management

6

Car Maintainence

2

0 responses on "Personal Tax Account and HMRC Online Services"